The rising importance of identity verification (IDV) in banking

Delve into the AI war's impact and its profound implications for the future. Explore the transformative role of artificial intelligence in shaping society.

Delve into the AI war's impact and its profound implications for the future. Explore the transformative role of artificial intelligence in shaping society.

The COVID-19 pandemic has hastened the transition to digital banking, with a 20% increase in the use of digital banking channels in the US during the pandemic, and similar patterns observed worldwide, according to McKinsey. As more customers turn to remote banking, IDV (Identity Verification) is critical to guarantee their identity and prevent fraudulent activities.

Banks are held to rigorous regulatory standards to prevent financial crimes, such as money laundering and terrorist financing. In the United States, the Bank Secrecy Act (BSA) mandates that banks create and keep a customer identification program (CIP) to authenticate the identities of their clients. Not adhering to these regulations can lead to significant penalties and harm to reputations.

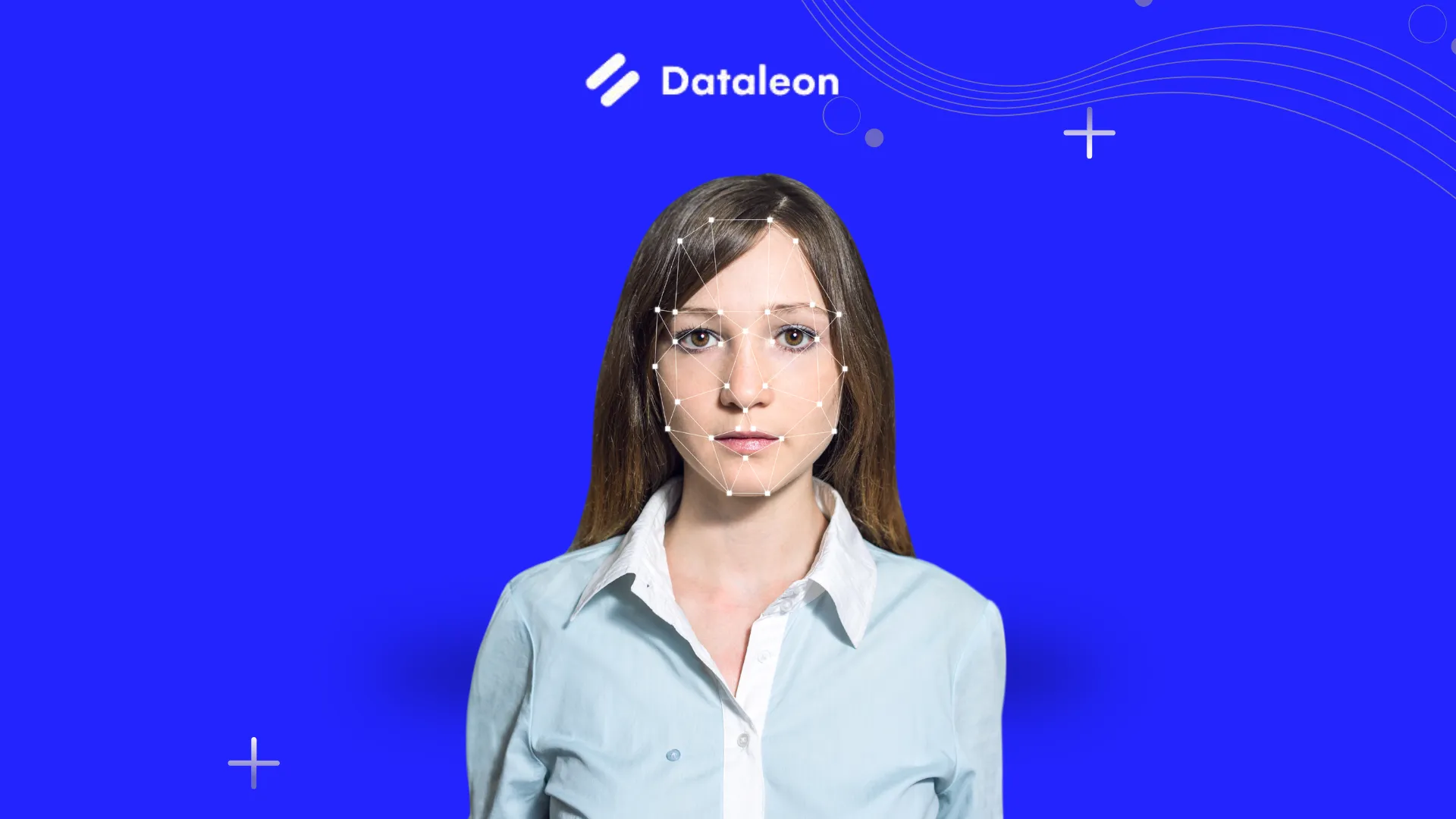

Thanks to advancements in biometric authentication technologies like facial recognition and fingerprint scanning, ID verification has become both more secure and more convenient for customers. The market for biometric identification is projected to experience substantial growth in the coming years, with an estimated increase from $16.8 billion to $36.6 billion between 2020 and 2025, indicating the banking sector's strong demand for biometric IDV solutions.

Instances of fraud, including identity theft, account takeover, and phishing attacks, have been rising steadily. In the US, identity theft alone accounted for 20% of all fraud incidents in 2020. As remote banking continues to gain popularity, the risk of such attacks has only increased, making Identity Verification (IDV) a vital component of banks' security measures.

Conventional IDV methods like in-person verification or submitting physical documents can be arduous and inconvenient for customers. With biometric authentication technologies, the process becomes more expedient and effortless. A survey conducted by Mastercard revealed that 93% of consumers preferred biometric authentication over passwords for making payments, demonstrating that biometric IDV solutions can greatly enhance the customer experience and drive customer satisfaction.

By automating the IDV (Identity Verification) process, banks can reduce the requirement for manual reviews, which saves time and expenses. According to a McKinsey study, automating the onboarding process could save banks up to 90% of customer onboarding expenses. Furthermore, efficient IDV measures can help banks prevent costly fraud incidents and legal proceedings.

IDV measures can be a powerful tool for banks in the fight against fraud and financial crimes, mitigating the risks of reputational damage and financial losses. According to a report by Experian, implementing IDV measures could decrease account takeover rates by up to 45%. Moreover, robust IDV measures can assist banks in complying with regulatory requirements and avoiding legal actions and fines.

The trends and insights highlighted in this article emphasize the growing significance of identity verification (IDV) in banking operations. With the surge of remote banking, increasing regulatory compliance requirements, and more frequent cases of fraud, effective IDV measures are crucial to ensure security and safeguard both the bank and the customer. The emergence of biometric authentication technologies is streamlining the IDV process, making it more convenient and secure for customers, as well as reducing costs for banks. Consequently, investment in IDV is likely to remain a critical area for banks in the future.

Contactez nos experts pour des solutions innovantes et personnalisées

Tester la plateforme gratuitementNous contacter.svg)

15 jours d'essai

.svg)

Pas de carte de crédit

.svg)

Annulez à tout moment